Understand Forex in 5 Minutes and How to start Forex trading

Forex is an international currency exchange market. It is the largest financial market in the world. Investors around the world, including institutions trade and exchange currencies. The retail investors can enter Forex trading by opening an account with an authorized broker. The advantage of Forex trading is that we can make a profit both up and down trend and use less initial money to start trading.

Where to open a Forex trading account?

You should only open an account with a trusted and accredited broker. Currently, I am trading Forex with Exness one of the most popular broker in Asia. Once registered, you can open a Demo account to try trading for free (Exness provides $10,000 virtual money in the Demo portfolio), or if you are confident and having some more experience, you can open a Standard real account where you have to transfer real money to trade. (Minimum transfer into the Standard portfolio is only $10 to start trading)

To open a Forex trading account with Exness click here

Advantages of opening an account with Exness

- Easy to apply, takes only 5 minutes to verify your identity.

- Transfer money to the port quickly and instantly No deposit-withdrawal fees (for some countries)

- Transfer money to the port easily in many ways, including via mobile banking

- Licensed and regulated by the British Financial Institutions Regulatory Agency (FCA)

What products do Forex brokers offer to trade?

The products available to trade in many Forex brokers are similar. There are currency pairs such as Euro per US Dollars (EUR/USD), British Pound per US Dollar (GBP/USD), Gold price per US dollar (XAU/USD) and even Cryptocurrency like Bitcoin and Ethereum. Beginners should start trading on EUR/USD as it is the most popular traded pair. Make it easy to buy and sell.

How can we profit from Forex?

If we analyze that the prices tend to go up

If we think that the EUR is likely to strengthen against the USD, then we will open a Buy position for EUR/USD at the current price. Let’s say it’s $1.1 (which means buying 1 Euro for $1.1) and after some time the EUR/USD price jumps to $1.2 and then we close the order. In this case, we will profit from that difference (i.e. 1 Euro can be exchanged for more dollars). This is a profit when the price increases higher the price we bought.

If we analyze that the prices tend to fall

On the other hand, if we think that the price of EUR is likely to fall and the USD is likely to strengthen, we start opening a Sell position for EUR/USD at $1.1 (which means selling 1 EUR for 1.1 USD), and over time the EUR/USD price goes down to $1.0 and we close the order, we will profit from the difference this time (like we selling when it’s expensive at first and buying back cheaper, we therefore make a profit on the price difference when the price goes down). This is considered a profit when the price is lower than the price we opened the order at the beginning.

Things to know before trading Forex

Lot with contract size

For each trade we have to choose the contract size by specifying the Lot size before submitting the order

- 1 Lot contract = 100,000 units of base currency

- 0.10 Lot contract = 10,000 units of base currency

- 0.01 Lot contract = 1000 units of base currency

If there is no leverage at all, we have to open 1 lot of EUR/USD contract, then we need around 100,000 Euros to open the contract (based on the rate of the main currency at that time), which is considered a very huge investment. However, various Forex brokers allow retail traders to use leverage to trade so we don’t have to reserve full capital for trading.

Leverage & Margin

Usually, buying other financial products such as stocks, gold etc. requires full payment, but in the world of Forex brokers give credit to retail traders, known as leverage, which we can choose how much leverage we use in trading such as 1:50, 1:100, 1:500.

Assuming we have only $1000 to start trading, if we decided to use 1:100 leverage, it will be as if we have money $100,000 to invest ($1000 x 100). When the purchase of currency pair has been completed we will not be required to pay in full amount. Only the amount of profit and loss that must be paid (which the loss will not exceed the amount of Margin or the funds that we place initiailly). if we trade in the right way we will be able to make unlimited profits but if we trade the wrong way, we only lose $1000.

PIP (Point in Percentage)

PIP is a unit of price fluctuation. In the past, most currency pairs in the Forex world had a quote with 4 decimal places, where PIP is a change in the 4th decimal point.

For example, the EUR/USD pair runs from 1.0001 to 1.0002 (price move up $0.0001), a 1 PIP increase.

A PIP change is a change in the price of a currency pair that increases or decreases by 1 unit of the 4th decimal place, but many brokers now add a decimal to the 5th digit known as a point. where 1 PIP equals 10 Points

For example, the EUR/USD currency pair runs from 1.00010 to 1.00020 is 1 PIP or 10 Point increments.

For Standard accounts

Trading 1 Lot, if the price moves up or down 1 PIP = $10.

Trading 0.1 Lot, if price moves up or down 1 PIP = $1.

Trading 0.01 Lot, if the price moves up or down 1 PIP = $0.10

Example of calculating profit earned from trading

Example one

Let’s say we use the following trading conditions:

- Leverage = 1:100

- Trade Lot size = 1 Lot

- We open a Buy EUR/USD position at the price of 1.10000 and the next day the price jumps to 1.10100, so we close position immediately.

As a result, we get a profit of $100.

The method of calculating is simply taking the closing price, subtracting the opening price, to find the difference.

1.10100 – 1.10000 = 0.00100

Get a price difference of 0.00100 or 10 PIP (or 100 Point)

For Standard account, trade 1 lot, if price moves up or down, 1 PIP equals $10 multiplied by 10 PIP equals $100 profit.

Example Two

Let’s say we use the following trading conditions:

- Leverage = 1:100

- Trade Lot size = 0.1 Lot

- We open an order to Sell EUR/USD at the price of 1.0000 and the next day the price go down to 0.99900.

As a result, we get a profit of $10.

The method of calculation is simply taking the closing price, subtracting the opening price, to find the difference.

1.00000 – 0.99900 = 0.00100

Get a price difference of 0.00100 or 10 PIP (or 100 Point)

For Standard account, trade 0.1 lot, if price moves up or down, 1 PIP equals $1 multiplied by 10 PIP equals $10 profit.

Equipment used for trading

Normally, we can trade the Forex through the website and applications of the Forex broker we registered account. Or else, we can trade through the MetaTrader application that we can download and install additionally on both mobile phones. Most Forex brokers support trading on MetaTrader already. The advantage of MetaTrader is that it has many trading functions and has a wider variety of indicators more than the broker’s applications.

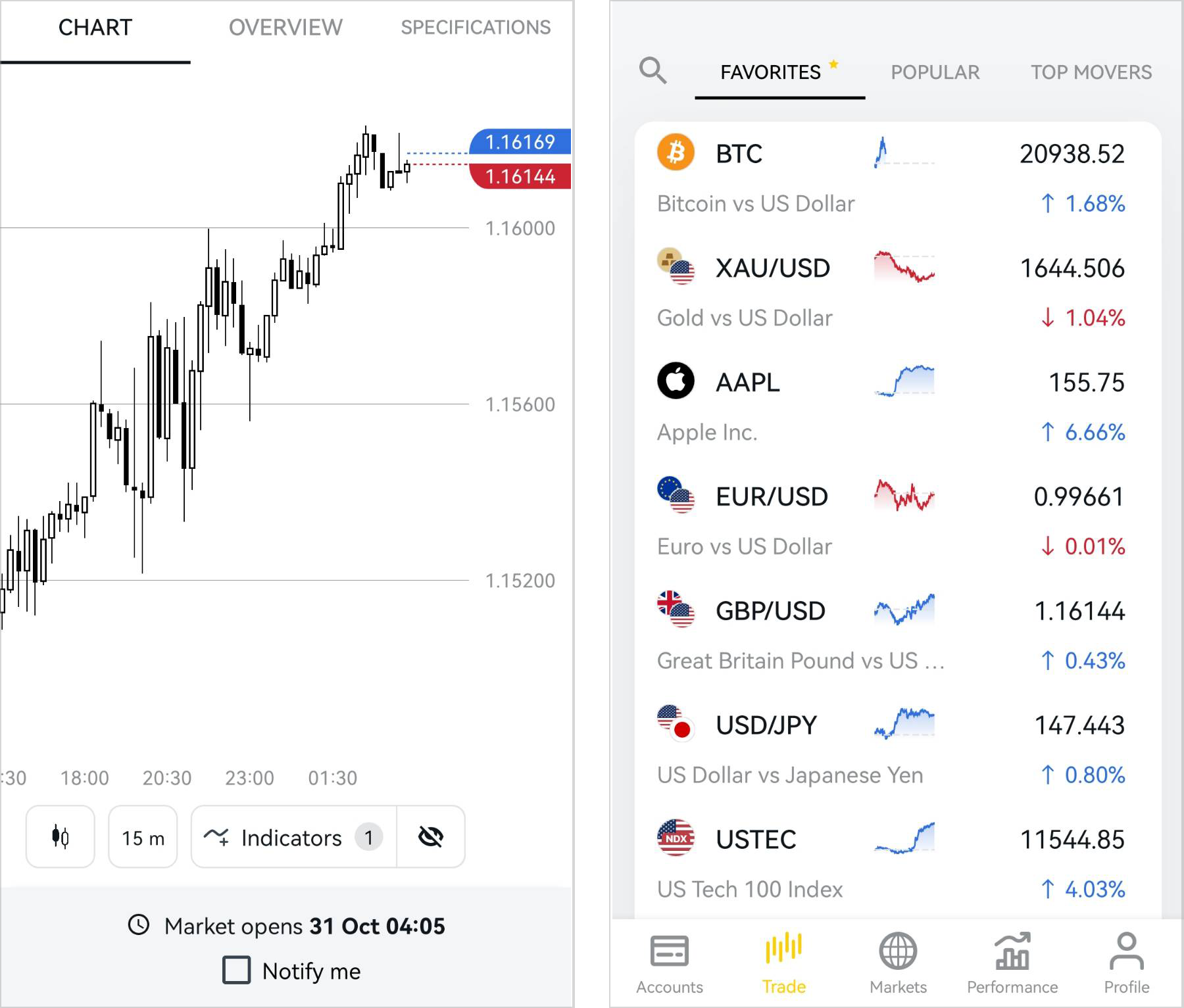

The image below shows the trading screen of the Exness mobile app, which has enough functionality for a beginner to trade. We can trade via mobile phone easily. The figure on the left shows the price chart of the currency pair. The image on the right shows the most popular products available for trading on Exness i.e. currency pairs, gold and even cryptocurrency are available for trading.

Other Important Things to Know About Forex Trading

- It is best to start trading with a Demo account first before trading with a Standard account with real money.

- For Standard account traders should start trading with small initial capital with low leverage and small Lot size

- Trader should study fundamental analysis, economic factors and follow the financial news that affects the currency of various countries. For example, trader who trade the EUR/USD pair, you should follow the news about interest rate announcements, inflation, economic policy from the FED, ECB and others.

- Trader should study technical analysis. Understand candlestick charts, price patterns, trend following and price support and resistance. Some traders even uses only technical analysis with little attention to fundamentals. Because it saves more time in trading than following the news. They believe that the events, including news, are already reflected in the prices on the candle stick charts before the news is actually announced to the public

Register for free and try the Exness demo accounts click here