CANSLIM, a Great Formula for Finding Super Stocks

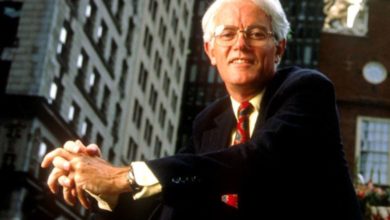

William O’Neil, author of How to Make Money in Stocks, has researched the characteristics that super stocks have in common. In summary, the basic concept is called CANSLIM.

CANSLIM consists of seven principles for stock selection, the purpose to find stocks that are likely to be super stocks in the future, or fast-growing stocks that have the potential to multiply their profits.

The seven principles of CANSLIM are:

C = Current Earnings Per Share

Look at the earnings per share (EPS) for the current quarter. Profits should be increased by at least 25% compared to the same period of the previous year. The higher, the better, and if the earnings increase from the last quarter too, that’s a very positive sign.

A = Annual Earnings

Look at latest year’s earnings per share (EPS) should be at least 25% or higher than last year (preferably look past three years). Check if the business still profitable or not? And check the ROE, which should be at least 17% or higher.

N = New Product or Service

The company has new ideas or release new products that helps to accelerate the growth of profits for the company (Think about when Apple made the iPod or iPhone in the early days) or had an action plan that lower production costs. This results in higher unit profit due to lower expenses. This will result in the share price being able to make a new high because the profit is increasing steadily. Buy stocks that are clearly in the uptrend. Often the stock prices of great company tend to go up further. Stock that seem cheap, the price can go lower as well if the company profit is not increase. In conclusion, the stock of a good company, the share price will grow with increasing profits and no one wants to sell it at cheap price.

S = Supply and Demand

You should interested in stocks which the management holds a large number of shares and there is not much stock left to trade in the market. If there were two interesting options and everything was equally good. Choose the company’s shares that are smaller and have fewer shares.

L = Leader or Laggard

Choose stocks of the “leaders” in their industry. Don’t buy stocks just because they are cheap. Since the stocks are so cheap, there might be a reason that the business is going bad.

I = Institutional Sponsorship

If possible, look for stocks that are just beginning to be held by financial institutions or funds. But be careful not to buy shares if there are too many financial institutions or funds.

M = Market Indexes

You should buy stocks during an uptrend market and checking at the various indexes as well. You shouldn’t buy the stock during the downtrend as most of the stocks price in the market tend to drop during the downtrend. A

In summary, the CANSLIM is not the principle of buying cheap and selling high, instead buying expensive price and selling at the higher price, including focusing mainly on choosing growth stocks. William O’Neill also suggested that buyer should also set the Cut Loss target at around 7%. If you buy the stock and the price drops 7% from your buying price, you should sell immediately. If you are interested in the principles of William O’Neill, you can find out more in the book How to Make Money in Stocks.