Six Stock Categories According to Peter Lynch’s Principle

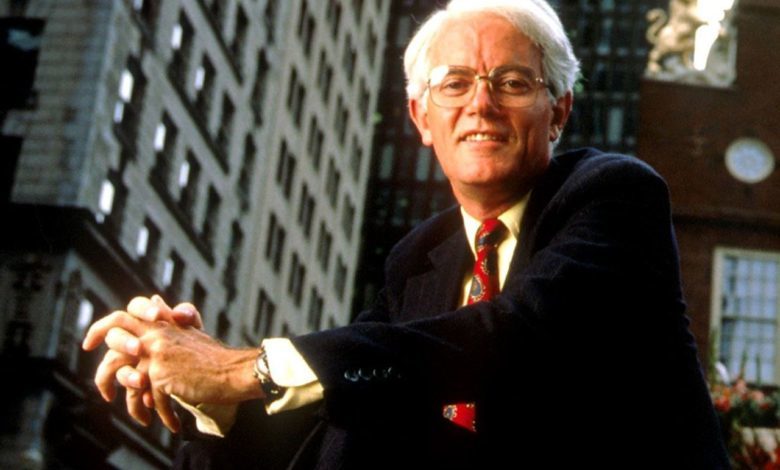

Knowing the classification of stocks will help us to understand the nature of the businesses of various companies and help us to formulate investment strategies that are more suitable for each stock category. This will be of great benefit to us when choosing to buy or sell some shares. Peter Lynch, a legendary stock investor (he was the fund manager of Fidelity Magellan) has divided stocks into six categories as following.

Slow Growers

It is often a stock of a large and long-standing company. Profit growth is approximately 2-4% per annum, possibly close to or slightly above the economic growth rate. This group of stocks may have been one of the fastest growing companies in the past. But at some point, the company could no longer grow or expand rapidly. Normally, stocks in this group usually pay fairly good and consistent dividends because the management doesn’t use much of the earned profits to expand the business, so there is money left over to pay as dividends to shareholders.

Stalwarts

It is usually a strong company that selling popular product to consumer. Company in this group tend to have profit growth rates of about 10-20% per year such as Coca Cola, Procter and Gamble, Colgate-Palmolive. And under normal circumstances, if you buy a stock in this group and make 50% profit, you should be satisfied. The likelihood of stocks in this group going up multiple times is very difficult. Unless the company has a business development plan and releases new products that make the company profitable to grow more than usual. However, these stocks tend to withstand economic crisis well because of their product is popular and is a necessity that people use. Even with the economic crisis, people still use the products of this group of companies.

Fast Growers or Growth Stocks

Peter Lynch said that he likes to invest in these stock categories. If you choose the correct one, you may find stocks that will go up ten or a hundred times in the future. The stocks in this group are usually small companies with high growth rates of 20 – 25% per year. Companies in this group may not necessarily be in a fast growing industry. And they tend to be very risky in companies that are just starting out. If we have stocks that are considered fast growing stocks, it is important that we analyze when the business will stop growing.

Cyclicals

For example, stocks in the automotive, airline, marine, steel, petrochemical, coal sectors.

The profits of the companies in this group will fluctuate according to the economic conditions and supply and demand in each period. This results in some years the company has very good profits and some years it becomes less profitable or may be a loss. In order to hold shares in this group, we must analyze the timing of when the business starts to recover and when the business starts to go into recession. If you buy the stock in the right timing, you can make huge profits quickly. But if you buy in the wrong timing, you may lose money quickly as well.

Turnarounds

Companies in this group often face problems that lead to bad business or losses in the past. Or some companies may be near bankruptcy, but not go bankrupt and later the company has returned to be profitable again, maybe by debt restructuring, change to new business model or sell the unprofitable part of the business out. These types of stocks are quite risky if we analyze the business incorrectly. But if we analyze correctly, it is considered a type of stock that we can earn huge profits

Asset Plays

Companies in this group own various types of assets. This could be in the form of stocks, land, buildings or other valuable assets that the general public may not realize. Perhaps it was an asset that the company had bought for many years and today the price of these assets has skyrocketed. If you want to buy shares in this group, you should find the stocks of the companies that we have analyzed that the market price is still low compared to all the assets that the company has. However, when playing stocks in this group, you have to wait for the stock market price to reflect the real asset price of the company.

You can read more details about six stock categories on Peter Lynch’s book “One Up on Wall Street.” In the book, he gives an example of American stocks with more details that we can apply his principle to any stock market all over the world.